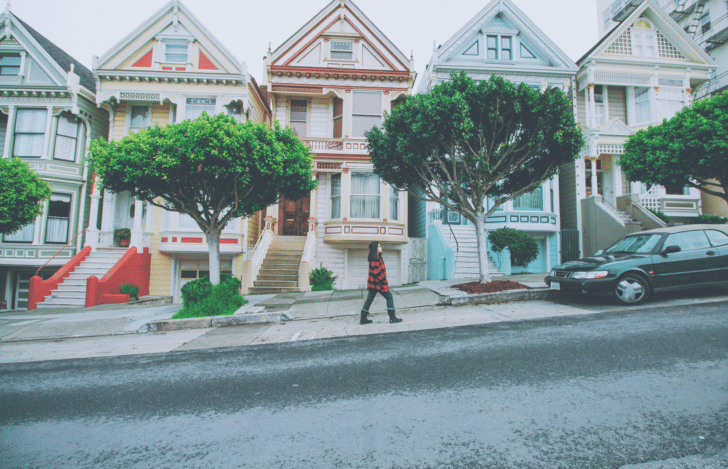

The Importance of Renter’s Insurance in San Francisco

23May

The Importance of Renter’s Insurance in San Francisco

With rising costs everywhere right now, many renters are looking to cut costs wherever they can. However, it is important not to drop your renter’s insurance. Though this can be a tempting cut to make, renter’s insurance offers many critical protections for tenants. Here are just a few of the many reasons why our attorneys believe it is important to carry renter’s insurance in San Francisco:

1. Your landlord’s insurance may not cover your losses.

Some renters assume that they do not need renters insurance because their landlord has insurance. This is not the case. First, your landlord may or may not have adequate insurance. Second, depending on the situation, your landlord's insurance policy may not cover your damages. For example, unless your loss is the result of your landlord's negligence your landlord may not be liable for damages. For damages you cause, or that are accidental, your landlord's insurance will not protect you and you could have exposure for thousands of dollars in losses.

If the landlord is liable for the damage, then their insurance very likely does cover a tenant's property damages. However, it can be helpful for a tenant to have insurance all the same if their unit is damaged or they are forced to temporarily relocate due to a fire, flood, or something else that is not necessarily the result of landlord negligence.

2. It protects you from financial losses associated with living in one of the most expensive cities in the entire country.

The Bay Area is notorious for its high cost of living. Rent is not the only thing included in the cost of living: personal belongings, appliances, medical bills, and other losses covered by insurance can also be higher in an expensive city. Renters insurance protects you by covering all these losses. It can also pay for a hotel, short-term rental, or another lodging if you are forced to temporarily or permanently leave your rental unit.

3. It may be required by your lease agreement.

Many lease agreements specifically state that the renter must carry insurance. If you fail to do so, you could be in breach of contract, and this could leave you personally liable for paying for uninsured losses. Paying your monthly premium is much easier than facing thousands of dollars in losses.

4. It protects you from liability for accidents in your home.

Did you know that you can be held legally responsible (“liable”) for accidents that happen on your rental property? Some accidents that result from poor maintenance (like a roof collapse) are likely your landlord’s responsibility. But if a guest slips and falls on something you spill in your house, you could be liable, and you could be on the hook for thousands of dollars in medical bills and other financial losses. The right renter’s insurance policy protects you from these costs by covering many types of household accidents.

Experienced San Francisco Tenants Rights Lawyers

Rising rent has created hardships for many families - especially here in San Francisco, one of the country’s most expensive cities. While there are many ways to cut back on household expenses, renter’s insurance should not be one of them. The affordable monthly premiums can save you thousands of dollars in uncovered losses and help provide comprehensive financial protection for you and your family.

At Wolford Wayne LLP, our tenants' rights lawyers are dedicated to helping families understand their rights as tenants and protect their best interests. For assistance with wrongful eviction or landlord harassment issues, contact us to schedule your consultation as soon as possible.

Related Posts You Also May Like

Get Started

For more information or to discuss your legal situation, call us today at (415) 649-6203 for a phone consultation or submit an inquiry below. Please note our firm can only assist tenants residing in San Francisco, Oakland & Berkeley.